In our last blog article we already described the past events and current impact of the coronavirus on the logistics and transport industry. According to experts, the industry in Germany will currently take eight to nine months to fully recover. The question arises, if everything will continue as it has before.

Warehousing1 has summarized the consequences but with different timelines and provides an outlook on what the logistics and transport industry can expect in the future.

Short-term Effects

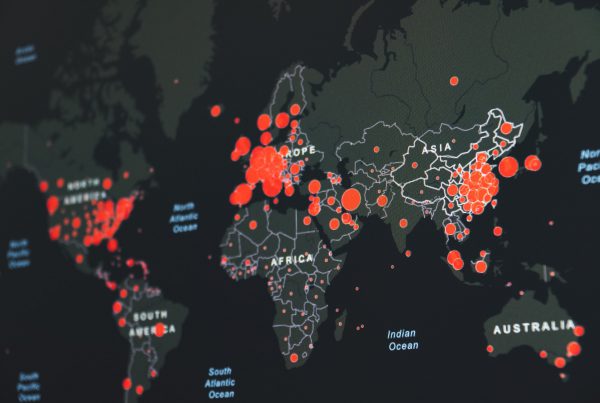

Good news for truck transport companies in June: The first relaxation of the Corona measures, such as the gradual opening of intra-European borders, means that the flow of transport in the logistics sector can start up again for the time being. However, the opposite is evident among shipping companies. Many transport ships were temporarily taken out of service at the beginning of June; 11,3% 11.3% of the container fleets worldwide are unused and are lying in the ports. Most of these are in Asia - more than ever before. Some of the crews are also not yet allowed to disembark and remain in quarantine. So while global waterborne transports are at a standstill, air freight traffic continues to increase at an above-average rate. This can be attributed to the fact that many companies have switched to air freight transport for onward transportation at short notice in order to avoid ongoing storage costs for increased inventories. This has proven to be particularly problematic in the current situation.

The sudden change in consumer demand for certain products, triggered by the Corona crisis, causes logistics managers in companies to react accordingly with repeat orders. As many supply chains show a lack of information transparency as well as long lead times, the consequence is the bullwhip-effect.The result: dramatically high inventory levels, which experts, say can only be reduced slowly. Companies lose liquidity in the short term, which is no longer available for further necessary investments.

Medium-term Effects

Covid-19 has strongly highlighted the gaps in supply chains. It is becoming increasingly clear that one aspect is particularly important as a prerequisite for functioning supply chains: creating transparency in the supply chain through digitalisation. After all, as long as global logistics networks cannot be fully interlinked, the economy, and especially the production facilities of large and medium-sized companies, will not be able to provide for an economic upswing. According to the Logistikweisen digitization is also a decisive success factor in the medium and long term, so that logistics service providers and companies can get back on track after the corona crisis. Companies are increasingly receiving additional support from innovative logistics start-ups to enable them to reactivate and/or re-optimize their supply chains. The direct effects of Covid-19 on supply chains can be read here .

In addition, many companies want to review and diversify the reliability of their suppliers. In the future, there will only be a few that rely on a single source of supply. This rethinking is being increased by the trends towards regionalisationwhich is intended to relieve the global supply chains. For many companies that were or still are affected by supply bottlenecks, including especially the European pharmaceutical industry, dependence on China, for example, was a major problem. Relying on more regional logistics service providers would break this dependency and could also be profitable from a cost perspective in the future, as wages in China are increasingly aligned with the European norm and Industry 4.0 offers new production opportunities.

Long-term effects

As soon as the crisis and economic upturn can be said to have been overcome, the focus will increase - alongside the parallel digital transformation - to climate change and sustainable action. After all, global climate protection targets also have a major influence on the design of supply chains.

One aspect that should promote sustainability is the decline in global supply chains. Trade conflicts and tariffs, such as between the USA and China, for example, made imports and exports from certain regions more difficult. As early as last year, this led to a trend to rely on national and local resources and trading partners. Promoting regionalisation has two advantages: on the one hand, supply chains become more resilient as global networks are redirected to local suppliers; on the other hand, it offers the possibility of ensuring more climate-neutral transport. For this to be interesting and feasible for companies, however, the cost-benefit calculation must be right. Thus, climate protection remains a long-term goal, which will increase after the economy has been built up.

Even before Corona, the main topics of digitalisation, regionalisation and sustainability were already an important directional guide for the future of the transport and logistics industry. The crisis now offers the opportunity to accelerate the digital transformation and regionalisation in particular. In any case, the focus will definitely increase on supply chains and their optimization in order to avoid bottlenecks, to operate cost-efficiently and, above all, transparently. In particular, resilience and flexibility can be increased through digital innovation. Warehousing1 is also already relying on digitalization, for example by using AI-based software that can identify the ideal service provider from a network of over 500 warehouse locations, and by using a comprehensive dashboard to provide an overview of data flows and enable full system integration.