There is no doubt that this year no topic will be more present than the Corona pandemic and its effects on our lives. The logistics sector has played a significant, unprecedented role in the development of the industry so far. On the one hand, since the industry has been severely affected, but much more importantly, since the logistics sector has an essential share of the responsibility for ensuring that life could continue to run relatively normally despite the lockdown.

Warehousing1 has summarized for you the most important developments of the last months with a special focus on the transport and logistics industry.

March: The Transport and Logistics Sector suffers

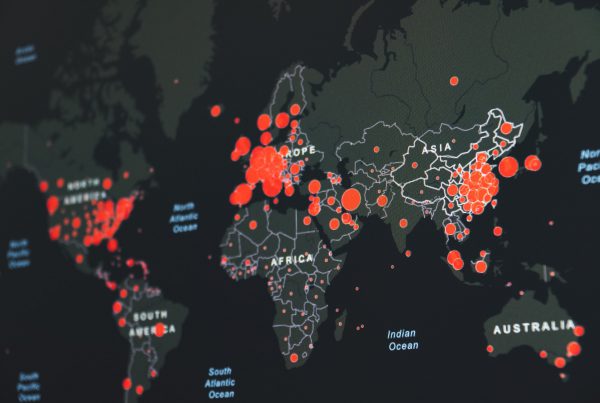

On 11 March the WHO speaks of a pandemic for the first time. Shortly afterwards, Chancellor Merkel addresses the nation, describing the corona crisis as the greatest challenge since World War II. As a consequence, public life is radically restricted: Shops remain closed with few exceptions, major events are cancelled, contacts are significantly reduced. While in Germany everything is now being done to contain the virus, in China measures are already being increased. However, in addition to the fundamental effects, problems in the transport and logistics sector are also becoming apparent there: 80% of China's transport volume has collapsed since the beginning of the year. This decline is reflected in Germany, as automobile manufacturers such as VW and Daimler are ceasing production, partly because necessary components could not be procured from China due to supply shortages.

In addition to China, Germany has to contend with further transport restrictions. Many truck drivers stand in queues for hours without food and cannot deliver their goods because the country borders can only be crossed with restrictions. Thousands of containers accumulate in the port of Hamburg because the goods cannot be transported to the shops. The lack of flexibility of many global supply chains is clearly evident here - but also the potential to optimise supply chains in the future and make them more resilient.

While transport logistics are struggling to cope with the effects of the virus, warehouse logistics must also prove adaptable. As a delivery stop for non-food manufacturers has been imposed since 17 March, many items are piling up in containers, ports and warehouses. Many capacities have been exceeded. Amazon is also responding to this and is discontinuing FBA for non-essential goods, which means that Amazon will only take orders for products in the household goods, medical supplies or other goods with high demand. As a result, many companies have to rent additional storage space to store their goods at short notice.

April: Losers and Winners

In April, the number of infected persons worldwide increases to more than one million, 70,000 of them in Germany In order to further contain the virus, travel restrictions are imposed in Germany and many other countries until at least mid-June, and a general obligation to wear masks is introduced. Major events like the popular Oktoberfest are cancelled. For the German economy, the effects are serious despite extensive state aid. In the automotive industry, manufacturers continue to fear for their supply chains and even if production is slowly being ramped up again; the transport business remains at a standstill, warehouses remain overcrowded. As a consequence of the many overcapacities, price collapses can be observed in the road haulage market. Freight rates that are too low and fixed costs that are too high are prompting many freight forwarders to switch to short-time working and make only limited use of their fleets. However, this business is hardly sufficient to cover costs.

But there are also fields that are experiencing enormous growth as a result of the crisis, such as e-commerce. The willingness to make purchases online is higher in Germany than ever before. Especially products such as children's toys, sportswear and equipment, and office supplies are selling remarkably well in online retailing. This means that mail order business is also growing. Mail-order service providers such as DHL are recording sales at "pre-Christmas levels". Orders and shipments increase as much as usual only during the peak season. For example, according to DHL, around 5.2 million parcels are normally delivered in Germany every day; in April, the figure was more than 8 million parcels per day. However, parcel services are also struggling with the negative consequences of Corona, such as extreme waiting times and delays due to border controls, as well as completely blocked destinations or employee absences due to virus infections.

Alongside e-commerce, freight traffic at Frankfurt Airport is booming at the same time. Transport has now increasingly shifted into the airspace. For example, passenger aircraft are being converted into freighters to transport primarily medical equipment or IT hardware products from China. Warehousing1 even received an enquiry for the short-term interim storage of aircraft seats from a converted passenger aircraft. Here, too, it is clear that supply chains need to be geared towards more flexibility so that logistics companies can guarantee supply at all times.

May: Back to normal?

Nationwide the contact restrictions continue to apply, although with some relaxation. The federal states may decide on the gradual opening of public life through daycare centres, fitness studios or restaurants on their own responsibility. The regional development of infection rates serves as a point of orientation. So far, the measures have achieved a large reduction in new infections in Germany and it appears that the virus has been contained to the first degree. Nevertheless, experts are warning of a second wave of infection, which is why the easing of restrictions should only be extended slowly. For the transport and logistics sector, this means a gradual opening of borders, so that traffic jams and delays will be less and less frequent. The border to Luxembourg is already open again, followed by Denmark. From 15 June, the borders of France, Austria and Switzerland will also join. However, it is not yet clear what the situation will be with the eastern borders like the Czech Republic and Poland.

According to Statista, an online portal for market and opinion research institutes, 53% of the entrepreneurs surveyed saythat they expect a very strong impact on their logistics company. Loss of production, loss of employees and truck stops are problems that need to be dealt with now. Government measures such as liquidity support, tax deferrals, guarantees, counter-guarantees for banks and relief for short-time work are intended to help in this regard. The loosening in May is also slowly getting the ailing supply chains back on track. It is apparent that already in the second week of May, activities in the supply chain are increasing by 8%, which is having a positive effect on production in the automotive industry in particular.

Which effects of the Corona crisis we expect in the near future for the transport and logistics industry, you can find out soon here on our blog.

Warehousing1 is happy to support and advise you and/or your logistics company in times of crisis like these. We work with the latest technologies and, through the use of AI-based software, can identify a trustworthy warehouse service provider from over 300 warehouse locations and submit customised offers. Through the intelligent selection of trustworthy warehouse locations and processes, as well as fully flexible billing models, we enable strong savings potentials, which can reduce costs by up to 50%. Even empty or overcrowded warehouses will no longer be a problem in the future. We would be happy to arrange an initial meeting with you today!